This past week, SSVP volunteers went by the encampment sites in the downtown core where individuals who are homeless are sheltering. Hats, gloves, socks, hygiene products, fresh fruit, and other items were distributed to those in need. More than 40 individuals, both men and women, were served. Many of our neighbours are facing the prospect of a cold winter living on the streets of our community. Please keep them in your thoughts as they struggle to get by.

Category: Uncategorised

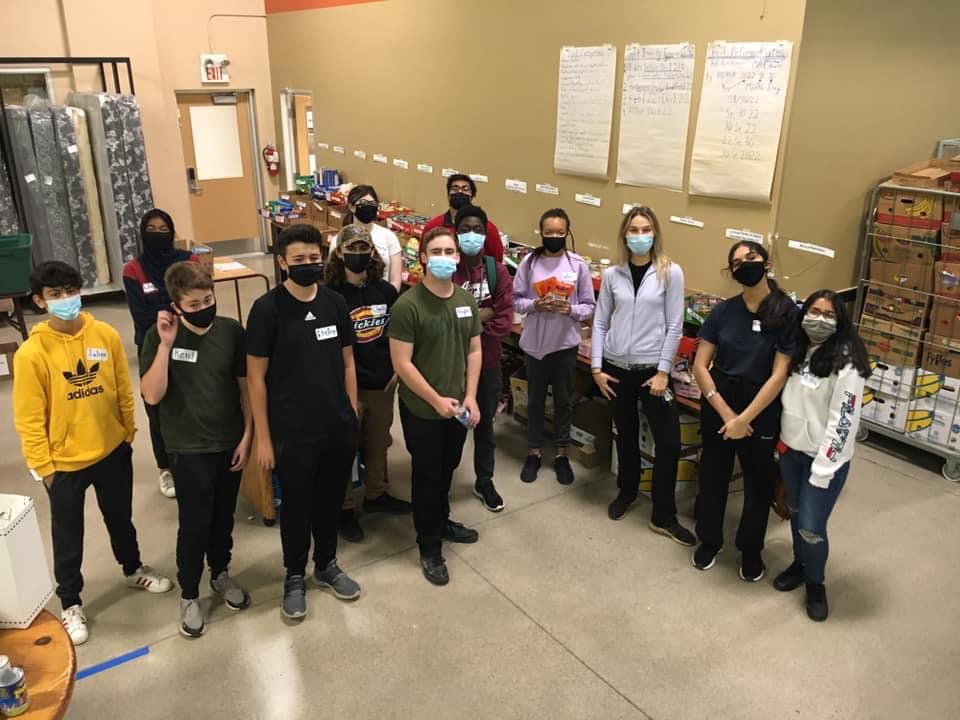

Sorting Food Donations

Peter Giordano, SSVP VP Youth, proudly organized and worked with Assumption College Prefects and St. John’s College students who helped sort the food from the food drives that St. Basil’s, Assumption College, Sacred Heart and Resurrection ran for us at St Vincent de Paul!! The students were absolutely great! The positive attitude, energy, enthusiasm and focus were truly inspirational and uplifting! ![]() Thanks

Thanks![]() to everyone for all of your help! Kudos!!

to everyone for all of your help! Kudos!!

Sunday November 14, 2021 – World Day of the Poor

November 14th, the 33rd Sunday in Ordinary Time, is the World Day of the Poor. We at the Society of Saint Vincent de Paul – Brant, invite you to help our less fortunate brothers and sisters, especially at this uncertain time. We encourage you to lend a hand by participating in our guignolée or in our collection of food supplies. In this very busy period, we always need volunteers and, of course, financial help is always appreciated. You may donate to the Society of Saint Vincent de Paul team in our community, or directly to the Society of Saint Vincent de Paul, via our website, at https://www.canadahelps.org/en/charities/the-society-of-st-vincent-de-paul-particular-council-of-br/

St. Vincent de Paul Thrift Store Celebrates 3rd Anniversary

It has already been three years since the opening of the new, bigger and better Society of Saint Vincent DePaul Thrift Store in Brantford. “Time flies when you’re having fun. It seems like yesterday that we moved into the old Crosby Cable YMCA building” quipped Thrift Store Manager, Kristine Paul. Kristine and her team of volunteers have planned a fun event to mark the three-year anniversary at the new store. All existing and former shoppers, donors, partners and benefactors and neighbours in need are invited to celebrate with Vincentian volunteers on Friday October 15 from 11:00am until 1:00pm. There will be free hamburgers, hot dogs and beverages and maybe even a few surprises.

The move to the new Thrift Store at 143 Wellington Street at Clarence started back in 2015 when the Society of Saint Vincent de Paul Brant sold their store at 197 Colborne Street and eventually purchased the former Crosby Cable YMCA building.

Many vivid memories come flashing back to Past President Pat Lenz when asked what comes to mind three years later. “I remember volunteers in hard hats and work boots, tirelessly preparing for the opening while we were still a construction site under renovation” recalled Mrs. Lenz. It was also a thrill for all volunteers to see the lineup of customers on the first day of opening, confirming that those very customers had found the store at its new location. It was an even bigger thrill to see the many mobility challenged customers scooting into and around the newly accessible shopping space.

Recently appointed Store Manager, Kristine Paul, has just launched a new $10 Gift Certificate. These new certificates can be purchased to give to prospective customers who have not experienced Thrift Store shopping, to current customers who enjoy the Saint Vincent DePaul Thrift Store experience or to give to friends and relatives on special occasions. All proceeds from the sale of the new $10 Gift Certificates go to help our neighbours in need.

The Saint Vincent DePaul Thrift Store retail space offers clothing in one large area for women, men, and children, furniture and household items. The larger space, large aisles, new shopping carts, bigger private change rooms and more choice makes for a pleasant shopping experience. All of the people who work in the store are volunteers, including supervisory staff, reinforcing the message of the gospel to serve Christ in the poor with love, respect, justice and joy.”

Contact: Mrs. Kristine Paul, Store Manager at the Thrift Store at 519-751-0143 or email at ssvpbrant@gmail.com

Changes to Our Procedures

Beginning July 16, 2021 we will increase the number of retail shoppers to 19 people at a time. Shoppers will queue 2 meters (6 feet) apart outside the store and will not be waiting in the lobby. Inside the store we will have a washroom and two fitting rooms open for our shoppers’ convenience. We will continue to follow our pandemic store shopping schedule of Tuesday, Thursday & Friday 10 a.m. until 2:30 p.m.

COVID-19 pandemic protocols continue to be in place for the safety and comfort of customers, donors and all of the staff volunteers. Face masks must be worn by all shoppers and volunteers. Social distancing will be in place and sanitizer will be available.